How The Average American Spends Their Money

How does the average American use their money?

Being the country with the highest GDP and one of the highest median annual salaries, you’d expect the majority of its citizens to be quite well off and financially stable.

But because of the lack of financial education, many Americans don’t know how to manage money appropriately. So how exactly do we Americans handle our money? And how can you build good financial habits?

Income

The first obvious question is how much money does the average American make yearly?

According to the Census, the median household income in the United States income in 2019 was $68,703. This places the United States as the country with the 6th highest annual household income.

Debt

“The average American debt totals $52,940. That includes mortgages, home equity, auto, student, and personal loans, plus credit card debt.” – Business Insider.

The majority of this debt was from people’s mortgages, with this accounting for $36,730.

Another $13,510 of this debt was from auto loans, student debt, and credit card debt.

Financial stability

Even though America is one of the wealthiest countries, with its citizens making a median yearly household income of close to $70,000, still a shocking number of people live paycheck to paycheck.

It’s clear that us Americans don’t handle our finances well, which makes sense considering only 18.4% of high schools require a personal finance course to graduate. And unless your parents teach you core financial skills, you’ll likely never learn about personal finance skills unless you take it upon yourself to learn for yourself.

So what exactly are the consequences of poor financial education?

Well, there is a very significant percentage of Americans living paycheck to paycheck, and many people can’t afford a relatively small unexpected debt.

According to Highland, an astonishing 63% – yes MORE than half – of Americans are living paycheck to paycheck. This number has surely increased significantly due to the pandemic but is still absolutely jaw-dropping.

And thats not all. The same survey revealed that 82% of Americans would not be able to afford just a $500 expense.

Investments

Investing is such an essential part of building wealth and is necessary for the average person to retire, but unfortunately, many people don’t know how to or start later in their lives.

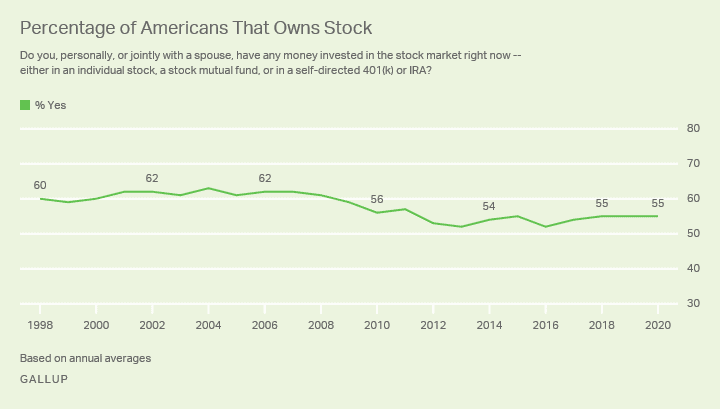

Only 55% of Americans invest in stocks, a percent that concerningly has been decreasing.

But even if you can’t afford much, investing a small amount of money will help you learn and build your investing skills.

Anyone over the age of 18 can invest money freely, but even if you’re a kid or teenager, you can begin to invest and help build good habits that will help you for the rest of your life.

To do this, you’ll need to open a special type of investment account with the help of your parents, called a custodial investment account.

“A custodial account is a financial account that is opened and controlled by someone over 18 for a minor. Often, a custodial account is opened by a parent for their child. Grandparents, other family members, and even friends can also open a custodial account for a minor” – Investopedia.

This means that as long as you get approval from your parents, you can make trades in the stock market.

Retirement

The average retirement age of US workers was 64, according to Money Talks.

While this isn’t the best average retirement age among developed countries, it’s certainly not the worst.

But how comfortable are retirees? And how much money do they typically save for retirement?

Well, the median retirement savings by age was found by the Transamerica Center for Retirement Studies. They found that the median savings by age were:

- $16,000 for Americans in their 20s

- $45,000 for Americans in their 30s

- $63,000 for Americans in their 40s

- $117,000 for Americans in their 50s

- $172,000 for Americans in their 60s

Unfortunately, it seems like many Americans don’t prioritize saving for retirement until later in their life. This means their investments won’t grow as much, and they will retire later or less comfortably than they could have.

If you want to learn more about American retirement, I would suggest reading this report because it has very detailed statistics regarding retirement.

How to build good financial habits

Its been established that the average American doesn’t have good financial habits. But how can you build good financial habits so that you have long-term financial stability and don’t need to worry about money?

Financial literacy

The first step to building good money habits is learning about financial literacy. Being financially literate is necessary in order to make good financial decisions.

“Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. Financial literacy is the foundation of your relationship with money, and it is a lifelong journey of learning. The earlier you start, the better off you will be, because education is the key to success when it comes to money.” – Jason Fernando, Investopedia.

There are many different ways to become financially literate. There are many different blogs and websites where you can read about other people’s experiences, and learn about different financial terms. One of my favorite sites for financial knowledge is Investopedia because they seem to have an article about almost everything. You can also watch YouTube videos and read books to learn even more about finance.

But where do you even start?

A great way to start is by assessing your current financial state. Evaluate your net worth, track your spending, and honestly assess yourself. From here, you can work on setting a goal and research a plan to complete it.

You might be thinking something like, “I’m young and don’t really need to worry about stuff like that.” But learning about personal finance early in your life will help you build good habits and reach your financial goals faster.

Even if you’re just a teenager, you can earn money, budget, save, and invest. Even just beginning to learn about personal finance will set you years ahead of most of your peers.

Emergency fund

Having an emergency fund is a crucial part of financial stability.

An emergency fund is money you set aside to cover large unexpected costs. This could be anything from fixing your car to losing your job. In case of an unexpected issue, having an emergency fund will allow you to cover the cost without having to go into debt or drastically change your lifestyle.

Consider setting aside around 1% of your income to build an emergency fund. Once you have enough money to cover 3 to 6 months of your living expenses, including rent, utilities, food, etc., you can stop adding to your emergency fund.

The pandemic is a perfect example of when an emergency fund is important. Many people lost their jobs, and although there were stimulus packages to provide some relief, many people are struggling to stay afloat. Having enough money to cover your expenses for a few months after being laid off would be very helpful and prevent you from facing significant financial issues.

I really can’t emphasize how much it matters to have enough money to fall back on in case of an unexpected expanse.

Investing

Investing is very important because it allows you to passively make money, as opposed to trading your time for money.

Additionally, interest from stocks compounds over time. This means that interest accumulates on money previously earned as interest to create exponential growth. The sooner you start investing, the soon you’ll benefit from compound interest.

But investing is a daunting task; where do you even start?

Well, first, you need to open an investment account. Just about every bank offers investment accounts, and there are tons of articles about which ones are best and how to open one.

For beginners who don’t know much about investing, investing in an index fund is the easiest way to generate consistent returns. To reduce risk, you can buy a bit of stock in an index fund every month, no matter the price, and do that consistently.