A Teenagers Guide to Investing in Cryptocurrency

Cryptocurrencies have been in the spotlight as Bitcoin’s market cap reaches 1 trillion, NFTs sell for tens of millions of dollars, Coinbase goes public, and DogeCoin skyrockets. In this post, I will discuss what cryptocurrency is, it’s recent explosion, and how to invest in it as a teenager.

“A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation” – Investopedia.

How cryptocurrencies work

Like with any investment, it’s critical to understand what you’re investing in. Cryptocurrencies are extremely confusing when you dig past the surface-level explanation and look at how they actually work. Although it isn’t necessary to understand all of the technical jargon, you should know how they work so you can understand their value.

There are thousands of cryptocurrencies with distinct differences, but almost all of them have one thing in common: blockchain technology.

“Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system. A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant’s ledger. The decentralized database managed by multiple participants is known as Distributed Ledger Technology (DLT)” – Euromoney.

What “cryptocurrency” really is:

There are critics of the name “cryptocurrency” who believe that most cryptocurrencies aren’t really practical as currencies:

“I think it’s a mistake really to call them currency at this point, to continue calling them currency because they’re crypto assets. It’s an asset. It’s not something that people use for transactional purposes on a regular basis” – Jason Hall.

When we talk about cryptocurrencies, we don’t use the same terms (inflation and deflation) that we would use to describe currency. Rather, we refer to price increases as “profit” and decreases as losses.

Although there are stable cryptocurrencies like Tether, which is tied to the US dollar, the largest cryptocurrencies like Bitcoin, Ethereum, Cardano, and Polkadot are really appreciating and depreciating assets.

What is the value of cryptocurrency?

There are thousands of different cryptocurrencies that each attempt to provide value in different ways. Here are some potential use cases for different cryptocurrencies:

Bitcoin

May argue that Bitcoin, the world’s largest cryptocurrency, could be used as an alternative to gold.

“As part of the transition toward a digital economy, Bitcoin could challenge gold as a global store of value. Economic history suggests that an asset accrues value as the demand for it increases relative to the supply. Demand is a function of an asset’s ability to serve the three roles of money: store of value, medium of exchange, and unit of account” – Bitcoin As An Investment by Yassine Elmandjra, Analyst at ARK Invest

Ethereum

Ethereum allows for the creation of “smart contracts.”

“A ‘smart contract’ is simply a program that runs on the Ethereum blockchain. It’s a collection of code (its functions) and data (its state) that resides at a specific address on the Ethereum blockchain. … User accounts can then interact with a smart contract by submitting transactions that execute a function defined on the smart contract. Smart contracts can define rules, like a regular contract, and automatically enforce them via the code” – Ethereum.org

Ethereum’s support of smart contracts has allowed for a whole new decentralized industry. Now, there are many applications of the Ethereum blockchain. For example, decentralized finance (Defi) is a rapidly growing industry and the exchange of art and collectibles through NFTs. Both really on the Ethereum blockchain

NFTs

“Non-fungible tokens or NFTs are cryptographic assets on blockchain with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency. This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can be used as a medium for commercial transactions” – Investopedia.

Essentially, NFTs are tokens that represent ownership of something. There is a wide range of things that can be turned into NFTs, including art, collectibles, video game items, and even real estate.

NFT creators can auction them off or charge a fixed price. Then, if a purchaser eventually wants to sell their NFT, they can auction it off to a different buyer. All of this is done, kept track of, and verified by the blockchain.

Chainlink

Chainlink is a cryptocurrency that connects real-world data to blockchains.

“Through the use of secure oracles, Chainlink extends the functionality of blockchains by connecting smart contracts to real-world data, events, payments, and more in a highly tamper-resistant and reliable manner” – Chainlink.

This allows for real world data to be used in smart contracts.

These are just a few of the many potential use cases for cryptocurrency. There’s an entirely new industry built off of blockchain technology.

How to invest in cryptocurrency as a teen

While it isn’t illegal to buy cryptocurrencies as a teen, major exchanges like Coinbase, Kraken, and Binance don’t allow minors to transact. This, unfortunately, makes it much more difficult for minors (people under the age of 18) to buy cryptocurrencies. However, there are still other perfectly legitimate ways of investing in cryptocurrency.

There are so many different apps and methods to buy Bitcoin as a teenager. However, the vast majority of them are difficult and expensive. Luckily, there are a few good options!

1. Greyscale

Buying one of Greyscale’s funds is the easiest, but in many ways, worst ways of investing in cryptocurrencies. Greyscale is a company that has multiple cryptocurrency funds that are publicly traded on the stock market, similar to an ETF.

“A trusted authority on digital currency investing, Grayscale provides secure access and diversified exposure to the digital currency asset class” – Greyscale

How it works is Greyscale buys and stores cryptocurrency. You can then buy shares of their trusts on the stock market. Even as a teenager, you can invest in this fund (and any other stocks) by opening a custodial investment account.

“The term custodial account generally refers to a savings account at a financial institution, mutual fund company, or brokerage firm that an adult controls for a minor (a person under the age of 18 or 21 years, depending on the laws of the state of residence). Approval from the custodian is mandatory for the account to conduct transactions, such as buying or selling securities” – Investopedia.com.

The main problem is that when you own shares of a Greyscale fund, you don’t directly own crypto; you own a derivative. This means there’s a disconnect between the cryptocurrency’s price and the fund’s price.

Because Greyscale’s funds are publicly traded, their price is determined by the market (just like any other stock). For example, if stock market demand for Bitcoin decreased, GBTC (Greyscale’s Bitcoin trust) price would fall, even if Bitcoin didn’t go down.

Because of this disconnect, the market cap of a Greyscale fund could be much higher (or lower) than its AUM (assets under management.)

All though this isn’t the best option to invest in crypto as a teenager, it is extremely easy, especially if you already have a custodial account.

2. Transfer

This method allows you to actually own cryptocurrency, unlike buying a Greyscale fund. For this method, you’ll need one of your parent’s (or another trusted adult’s) help.

1. The first step is to create a cryptocurrency wallet.

“Crypto wallets keep your private keys – the passwords that give you access to your cryptocurrencies – safe and accessible, allowing you to send and receive cryptocurrencies like Bitcoin and Ethereum” – Coinbase.

You’ll have to choose a wallet based on what cryptocurrency you want to invest in because wallets only support specific cryptos. Click here to browse the best Bitcoin wallets, and click here to browse Ethereum wallets.

2. Once you’ve created a wallet, find a trusted adult who already has an account on a crypto exchange. Alternatively, find a trusted adult who would be willing to help you by registering for a reputable exchange like Coinbase or Binance.

3. Once you’ve found a trusted adult willing to help you, give them money to buy however much cryptocurrency you want to own. Then, have them transfer the crypto into your wallet. Once the crypto is in your wallet, it’s yours!

You should still be able to spend your cryptocurrency if you want. However, it will be harder to sell your cryptocurrency since your not using an exchange.

3. Peer to peer exchanges

“Peer-to-peer exchanges are marketplaces where people can trade crypto directly with each other” – Cryptotesters.

Essential, peer-to-peer exchanges allow you to directly buy and sell crypto from individual people without going through an exchange. How they work is individuals can create “listings” where they can choose how much of a premium to charge for selling cryptocurrencies, what payment method to accept, and minimum order amounts.

There are two main problems to this approach:

1. Crazy prices

Because these exchanges are P2P, sellers charge a premium that varies in price. However, to exchange money for crypto from a trusted seller, you’ll likely have to pay at least a 10% to 20% premium.

2. Susceptible to scams

In contrast to centralized exchanges, P2P exchanges deal with individual people who may have malicious intent. Using a P2P exchange leaves you much more susceptible to scams, luring you in with low premiums. If you do end up using this method, be careful and exclusively deal with well-rated sellers.

Is it a bubble?

As the crypto market cap explodes, it’s impossible not to wonder, “Is this sustainable?” Back in 2017, when cryptocurrency had its first explosion, in only a matter of months, prices fell to only a small fraction of their previous highs.

In the years since then, crypto had gone mostly unnoticed, until late 2020 when cryptocurrencies exploded once more. Since then, the crypto market has climbed even further, with the total value of crypto being worth almost $2 trillion.

But what’s different? Are prices going to crash again, just like in early 2018? Although it’s impossible to predict the future, there are a few key differences between 2017-2018 and now, the biggest being institutional interest.

Institutional intrest

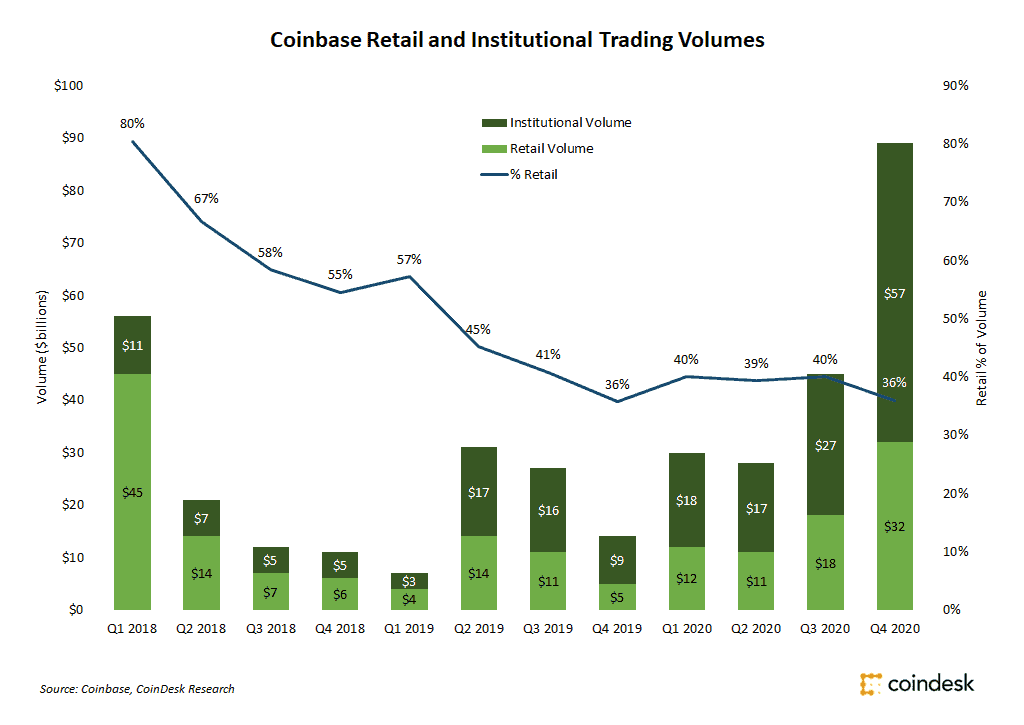

The recently public cryptocurrency exchange Coinbase released a breakdown of retail vs. institutional trading volume for the past three years.

“Retail customers represented just 36% of trading volumes during the fourth quarter, down from 80% in early 2018, Coinbase’s regulatory disclosures showed. That means the bulk of volume has shifted in recent years toward institutional customers, mirroring the broader industry shift as more big investors nose into crypto markets. But the growth rates of volume from each demographic remained roughly equal in the past year” – – Coindesk

Since mid-2019, institutional trading volume has represented over 50% of Coinbases trading volume.

This means that the bulk of cryptocurrencies market cap isn’t mainly retail investors looking to make a quick buck anymore. Rather, institutions are increasingly seeing the value of cryptocurrency and are holding large, long-term positions. This means that the value of popular cryptocurrencies is decreasing in volatility because for a large crash to occur, institutions would have to start selling.

Highlights:

- “A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend” – Investopedia.

- There are thousands of cryptocurrencies with distinct differences, but almost all of them have one thing in common: blockchain technology.

- There are thousands of different cryptocurrencies that each attempt to provide value in different ways. Each cryptocurrency has a different goal.

- Essentially, NFTs are tokens that represent ownership of something. There is a wide range of things that can be turned into NFTs, including art, collectibles, video game items, and even real estate.

- While it isn’t illegal to buy cryptocurrencies as a teen, major exchanges like Coinbase, Kraken, and Binance don’t allow minors to transact. However, there are still other perfectly legitimate ways of investing in cryptocurrency.

- How it works is Greyscale buys and stores cryptocurrency. You can then buy shares of their trusts on the stock market.

- You can directly own cryptocurrency by creating a crypto wallet and giving a trusted adult money to buy cryptocurrency and transfer it into your wallet.

- Peer-to-peer exchanges allow you to directly buy and sell crypto from individual people without going through an exchange. However, they have significant flaws.

- Since mid-2019, institutional trading volume has represented over 50% of Coinbases trading volume.

- Because the majority of trading volume is coming from institutions, for a large crash to occur, institutions would have to start selling.

Thanks for reading!