Credit vs. Debit: A Guide for Teenagers

Credit and debit cards are a confusing subject that we don’t learn about in school. It makes sense then that there’s so much confusion surrounding the subject.

But understanding debit and credit cards, their differences, pros, cons, and how to use them is a necessary skill. As a teenager, it’s important to start learning about debit and credit, so you’re prepared to appropriately use them as an adult.

What is a debit card?

“A debit card is a payment card that deducts money directly from a consumer’s checking account when it is used” Investopedia.

Instead of using physical cash to make purchases, you can use your debit card thats linked to a bank account to pay for things and even make online purchases.

How to get a debit card as a teenager

“A child can typically get a debit card at 13 when a parent or legal guardian opens a joint teen checking account on their behalf. Teen checking accounts are typically available until the child turns 18. When the account holder becomes 18, it’s common for the account to automatically roll into a regular checking account without the same spending or withdrawal limits” – Alliant Credit Union.

So once you turn 13, you’ll be able to open a checking account and get a debit card so you can make online payments, transfer money, avoid the hassle of using cash, and benefit from the additional security provided by the FDIC.

“The FDIC (Federal Deposit Insurance Corporation) is an independent agency of the United States government that protects you against the loss of your insured deposits if an FDIC-insured bank or savings association fails. FDIC insurance is backed by the full faith and credit of the United States government. The FDIC covers the traditional types of bank deposit accounts – including checking and savings accounts” – The FDIC.

This essentially means your money will be much more secure if you keep it in a bank account –– connected to your debit card –– than keeping it in cash where it could be lost or stolen.

The physiology of spending intangible money

Having a debit card as a teenager before having a credit card will help you understand how card payments work and help you get used to spending intangible money.

You see, the psychology of spending money with credit and debit cards is very different from physical cash.

“It’s easy to convince yourself, without even knowing it, that you’re not spending “real” money when you charge on your credit card. And technically, that’s correct. “In fact, you’re not really spending money — you’re borrowing money,” writes author and certified public accountant Michele Cagan in her book, “Debt 101.” “You know that you’ll have to pay the bill eventually, but the promise of small minimum payments can make purchases seem like bargains.” Unless you pay back the purchase immediately, you won’t feel the pain of the bill for basically a month” –– Nerdwallet

By getting used to spending money on a debit card, it will be easier to use credit cards appropriately as an adult because you’ll have had time to adjust to the psychology of credit cards.

What is a credit card?

“A credit card is a card issued by a financial institution, typically a bank, and it enables the cardholder to borrow funds from that institution. Cardholders agree to pay the money back with interest, according to the institution’s terms” – Mark Cussen, Investopedia.

Debit vs. credit cards

Debit and credit cards are often confused because they look similar, as well as have similar names and functions, but they are actually very different.

The simplest way of putting it is that when you spend money on a debit card, you are spending your own money. If you don’t have enough money in your checkings account to make a purchase, then you won’t be allowed to.

In contrast, when you spend money on a credit card, you’re not spending your own money; you’re borrowing the money from a lender. If you don’t immediately have enough money to make a purchase, you can still make the purchase and will have until the end of the month to pay for it.

This is the crucial difference between debit and credit cards to understand.

The danger of credit cards

All though having credit cards and a good credit score is important, credit cards can be dangerous. When you use a credit card, you are taking out short-term debt that you’ll ideally pay off by the end of the month. But if you don’t pay back your debt on time because you forgot, or overspent, you’ll have to pay it back with significant interest.

According to creditcards.com, as of June, the average annual interest rate was a crippling 16.14%. At such a high interest rate, credit card debt can quickly snowball into a crushing amount of debt.

For example, if you had a $10,000 debt, you would have to pay off $1,600 every year in interest just for the debt not to increase. This makes it incredibly difficult to pay off credit card debt.

Why bother to use credit cards?

If the main difference between debit and credit cards is that credit card purchases borrow money, and credit card debt can be a significant problem, why bother using credit cards at all? Well, there are two big reasons, rewards and credit scores.

Not all credit cards are created equal. Some credit cards have cashback, discounts, and rewards points to try and incentivize you to use their credit card over a competitor’s.

Although you shouldn’t be spending money just to get these rewards, having even just a small reward for your purchases can add up to a significant amount.

What is a credit score?

The other, bigger reason that credit cards are important is that how you use them determines your credit score.

Credit scores have a significant effect on your financial stability, so it’s crucial to understand, even as a teenager, so you’re prepared to make good decisions as an adult.

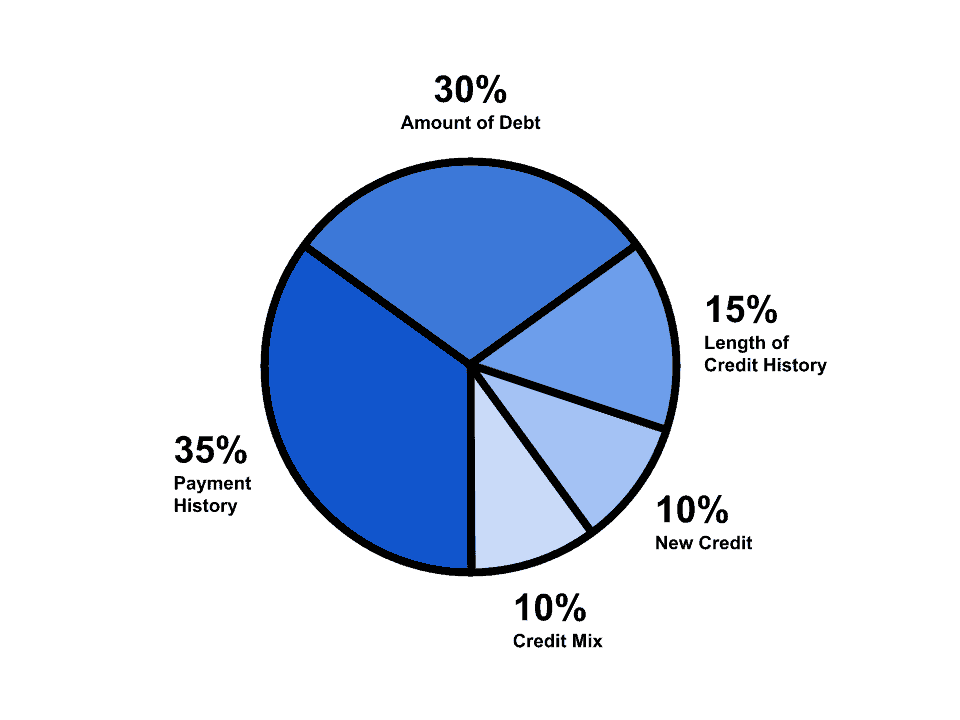

“A credit score is a three-digit number, typically between 300 and 850, designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated using information in your credit reports, including your payment history, the amount of debt you have, and the length of your credit history. Higher scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit” – Equifax.

Here you can see a breakdown of how FICO scores – the most commonly used credit score – is calculated.

Getting a credit card

In order to get a credit card, you have to be at least 18 years old. When you first start off, your credit score won’t be good, but if you maintain good habits, your score will quickly increase.

To learn more about credit scores, click here.

Why credit matters

“Your credit scores determine a lot more than the loans you can get and the interest rates you pay. Insurers use credit scores to set premiums for auto and homeowners coverage. Landlords use them to decide who gets to rent their apartments. Credit scores determine who gets the best cell phone plans and who has to make bigger deposits to get utilities” –– Nerdwallet.

Having a high credit score signals that you are responsible with money and, more specifically, debt. For example, this means that you’re a lower risk to lenders and will be able to qualify for a lower interest rate on loan. This is just one of the many ways that having good credit will help you.