How to Invest as a Teenager in 2021

Click here for a more comprehensive and up-to-date version of this article!

Investing is a great way to build wealth and can help almost anyone reach their financial goals. Instead of leaving all of your money in a savings account, make your money work for you by investing.

I started investing when I was 12, and the process was very confusing. There was very little information about investing for anyone under the age of 18, so hopefully, this post provides a good starting point for anyone in the same position.

Even though I’m by no means an expert on the subject of finance, I can hopefully provide a helpful perspective as a teenager myself.

Why investing matters

There are three reasons that make investing an extremely important skill to learn: it’s scalable, passive, and compounding.

Scalable

Investing is easily scaleable, unlike traditional work where you put in time to get money and you have a limited amount of money you can make. But with investing, you can invest as much money as you have, and add more and more to your investment portfolio.

Passsive

One of the best parts about investing is that it’s almost completely passive. This means that – depending on your investing strategy – it doesn’t require much work after your initial investment.

Compound interest

Over time, your investments will produce compound interest.

“Compound interest is interest earned on money that was previously earned as interest.” – thebalance.com

This is the concept that causes investments to grow exponentially. The sooner you start investing, the faster you can start taking advantage of compound interest.

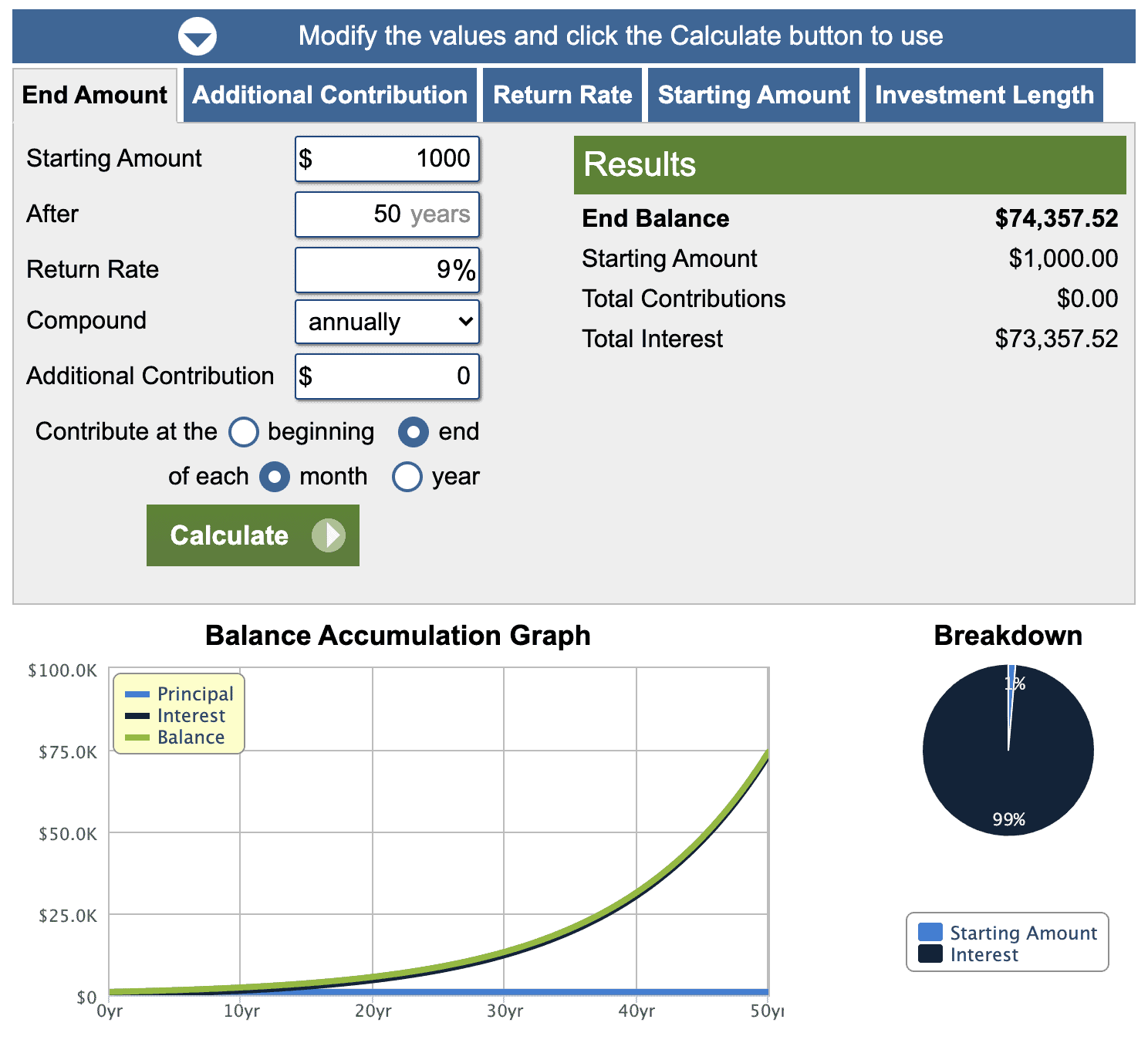

Here you can see the hypothetical growth of $1,000:

As you can see, over a long period of time, even just a little bit of money slowly growing can add up to a shocking amount.

Investing vs. Saving

Even though investing can be very beneficial, you shouldn’t invest money you know you will need in the near future. Due to the volatile nature of the stock market, your investments could lose value, and it may take time to recoup your losses. Because of market volatility you should only invest money that you’re not going to need for at least a few years.

Because your investments may loose value in the short term, Investing is not a substitute for saving and you should continue to save money even if you start investing.

Understand the basics of stocks

A stock share represents partial ownership of a company, including its assets and earnings. Stocks can be traded between investors on stock exchanges. Stocks change value because of changes in supply and demand.

Other investments

While stocks are the most common investment, there are other things you can invest in, such as bonds, commodities, cryptocurrencies, real estate, and more. In this post, I’m only going to be talking about stocks because they are the most common investment and are accessible for teens who may not have much money.

You also can’t own a lot of alternative investments (such as crypto currency or real-estate) in a custodial account directly although there are ways around this limitation.

Custodial accounts

“The term custodial account generally refers to a savings account at a financial institution, mutual fund company, or brokerage firm that an adult controls for a minor (a person under the age of 18 or 21 years, depending on the laws of the state of residence). Approval from the custodian is mandatory for the account to conduct transactions, such as buying or selling securities” – investopedia.com.

This means that even though you can’t invest by yourself as a teenager, you can still buy, own, and sell stocks with the approval of the parent or guardian (custodian) you make your custodial account with.

Custodial account taxes

You may have to pay taxes on the money made in your custodial account. Keep in mind tax laws do change frequently so make sure to do your own research.

“Any investment income—such as dividends, interest, or earnings—generated by account assets is considered the child’s income and taxed at the child’s tax rate once the child reaches age 18. If the child is younger than 18, the first $1,050 is untaxed, and the next $1,050 is taxed at the child’s rate. Anything over $2,100 is taxed at the parent’s rate.” – schwabmoneywise.com

Funds in your custodial account are also considered for financial aid.

“Custodial accounts can have a heavy impact on financial aid. Because the money in a custodial account is your child’s asset and not yours, federal financial aid formulas consider 20% of the money available to pay for college.” – schwab.com

Opening a custodial account

This article by thebalance.com does a great job explaining the best custodial accounts and their unique features and serves as a great place to start your research. Personally I use Stockpile’s custodial account because it gives you the most control over your investments. I will write a full review of Stockpile to help you understand how it works, and it’s pro’s and con’s. The actual process of opening an account once you’ve decided on who to open the account with depends; however, it should be relatively straightforward.

Choosing what to invest in

When choosing where to invest your money, there are a few things you should defiantly think about. One significant factor in determining where to put your money is risk level. Some companies are volatile, meaning their price changes quickly and dramatically. Investing in volatile companies can lead to high returns, but there is also a significant risk that the stock could quickly lose value, at least in the short term. Well-established companies are usually less volatile and generally offer a more constant increase in value over time. However, the upside is typically a lower.

This, of course, is a broad generalization, and a companies volatility is less important than its underlying value in the long run.

ETFs

One way to manage the risk of your investments is by investing in ETFs (exchange-traded funds). ETFs are large groups of securities (financial assets that can be traded). For example, Vanguard Total Stock Market ETF (VTI) tracks the entire US stock market. This means that you would own a tiny portion of every company with a stock listed on the US stock market. Pretty cool, right?

One of the benefits of investing in ETFs is that they help you diversify.

“Diversification strives to smooth out unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others. The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated—that is, they respond differently, often in opposing ways, to market influences.” – investopedia.com

Although diversification doesn’t guarantee your investments won’t go down in value, it does help mitigate risk.

The takeaways

Below is a summary of the key points of the post:

- Investing is an important way to grow wealth.

- A share represents partial ownership of a company, including its assets and earnings

- Stocks aren’t the only thing you can invest in.

- Custodial accounts allow you to invest with your custodian’s approval.

- Custodial accounts have tax benefits.

- Custodial accounts are considered for financial aid.

- Think about volatility when you invest.

- ETFs are large groups of financial assets that can be traded.

- While ETFs are by no means the only way, they do help you diversify your stock portfolio.

Hopefully, this post helped you understand how to start investing as a teenager! This isn’t a comprehensive guide, but it should be a good place to start your investing journey. Thanks for reading!