The 3 Most Important Financial Lessons for Teenagers

Knowing how to handle your money is a critical skill to have, even from a young age. Learning these three financial lessons as a teenager will prepare you for a lifetime of financial success.

1. Understand compound interest and the importance of investing early

If you only take one thing away from this article, it should be the importance of compound interest. Understanding the power of compound interest as a teenager will hugely benefit your finances.

“Compound interest accrues and is added to the accumulated interest of previous periods; it includes interest on interest, in other words.” – Steven Nickolas, Investopedia.

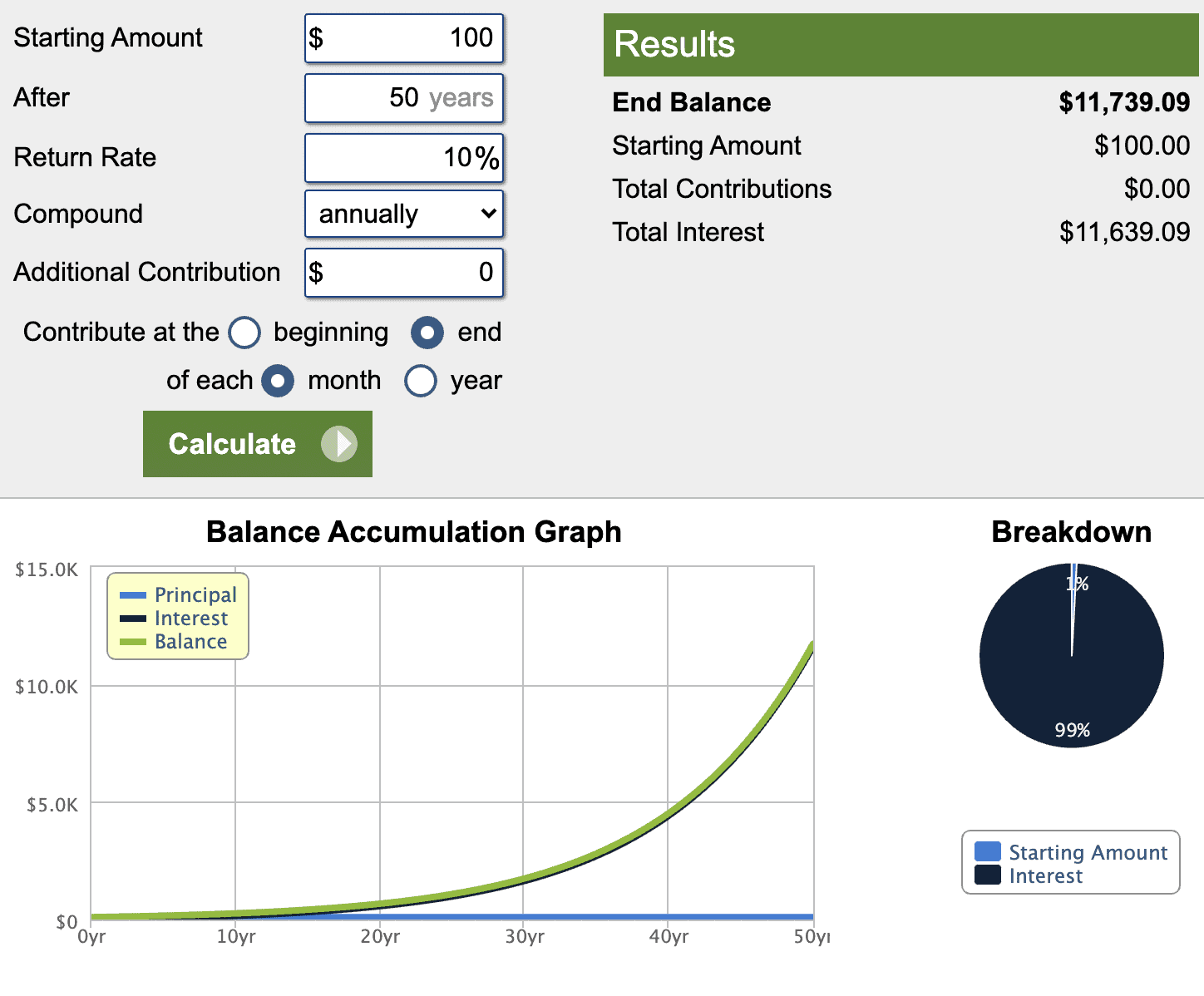

That means that instead of growing linearly, long-term investments will grow exponentially. Assuming your investments generate an average of 8-10% per year, your money will have made significant returns by the time you are ready to retire. Here you can see an example of compound interest over a long period of time:

As you can see, even investing a little money early in your life can turn into a lot of money over a long time.

I would recommend using an app or website to play around with different scenarios of compound interest by changing the annual return percentage, starting amount, additional contributions, etc., to help you visualize different scenarios.

I would recommend calculator.net’s investment calculator or an app called “Compound Interest Calculator – Future Value” because they are user-friendly and provide visuals.

To maximize the power effect of compound interest, start investing as much money as possible as early as you can. To do this, you need to know how to invest and have money to invest.

To invest in the stock market, you first need to open a brokerage account. There are many different brokerages, and which one is best for you depends on what you are personally looking for. This article by Forbes does a great job breaking down which brokerage is best depending on what you are looking for.

And while there’s a common stereotype that investing is for boring adults and old people. However, that couldn’t be further from the truth. Investing is a critically important part of building wealth that anyone who wants to can do.

Even if you are currently under the age of 18–although it will be a bit harder to start investing–you too can open a brokerage account. As a minor, you can begin investing by opening a custodial account with your parents.

“The term custodial account generally refers to a savings account at a financial institution, mutual fund company, or brokerage firm that an adult controls for a minor (a person under the age of 18 or 21 years, depending on the laws of the state of residence). Approval from the custodian is mandatory for the account to conduct transactions, such as buying or selling securities” – Troy Segal, Investopedia.

So while you can’t invest by yourself as a minor, with the help of your parents you can begin investing. If you’re interested in opening a custodial account, I recommend you read this article about the three best custodial accounts for teenagers.

Not only does beginning to invest early allow you to take advantage of compound interest, but it also serves as a great learning opportunity. If you start investing when you are young, you’ll learn all of the investing lingo and learn what investing style works for you. Since you still have your whole life to recover from any mistakes, the stakes are a lot lower than if you begin investing as an adult.

2. What ETFs are and how to invest in them

“An exchange-traded fund (ETF) is a type of pooled investment security that operates much like a mutual fund. Typically, ETFs will track a particular index, sector, commodity, or other assets, but unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way that a regular stock can. An ETF can be structured to track anything from the price of an individual commodity to a large and diverse collection of securities. ETFs can even be structured to track specific investment strategies.” – Investopedia.

In other words, an ETF is a group of companies (usually related in some way) that is bundled together and can be bought or sold like a stock. For example, rather than having to buy the top 50 energy stocks individually, you could invest in an energy ETF.

The main benefit of investing in ETFs is that they allow you to easily diversify your stock portfolio.

“Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt at limiting exposure to any single asset or risk. The rationale behind this technique is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk of any individual holding or security” – Investopedia.

In plainer English, diversification exposes you to different types of investments, thereby generating consistent returns and reducing risk. Rather than needing to invest in hundreds of companies manually, you can simply invest in a single ETF and gain the same benefits.

The only catch is that ETFs have what’s called an expense ratio. This is the (usually) small fee you have to pay to have your money managed. For most passively managed funds that track indexes like the S&P 500, these expense ratios are negligible. Actively managed ETFs, on the other hand, can have expense ratios around 1%, which will significantly reduce your returns.

If you want to learn more about ETFs, check out this article by our new writer, Mustafa!

3. How credit cards work and why they matter

“A credit card is a card issued by a financial institution, typically a bank, and it enables the cardholder to borrow funds from that institution. Cardholders agree to pay the money back with interest, according to the institution’s terms” – Mark Cussen, Investopedia.

Unlike debit cards, you have to be 18 to open a credit card. Unfortunately, many people don’t open a credit card until they’re well into their twenties because they just don’t see the need. In fact, many people think that using credit cards is irresponsible because it relies on short-term debt. You might be wondering, “If you can afford to buy something, what’s the point of purchasing it with a credit card?”

Well, the answer is simple. Credit cards can give you cash back and other rewards that save you money. But more importantly, responsibly using credit cards is necessary to build a credit score.

“A credit score is a three-digit number, typically between 300 and 850, designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated using the information in your credit reports, including your payment history, the amount of debt you have, and the length of your credit history. Higher scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit” – Equifax.

Your credit score is a critical number that helps to determine if you will be given a loan or mortgage and what the interest rates are for those loans. Your credit score may also be considered when you want to rent a house. Because credit scores are so important, having a good credit score is a significant part of your financial well-being.

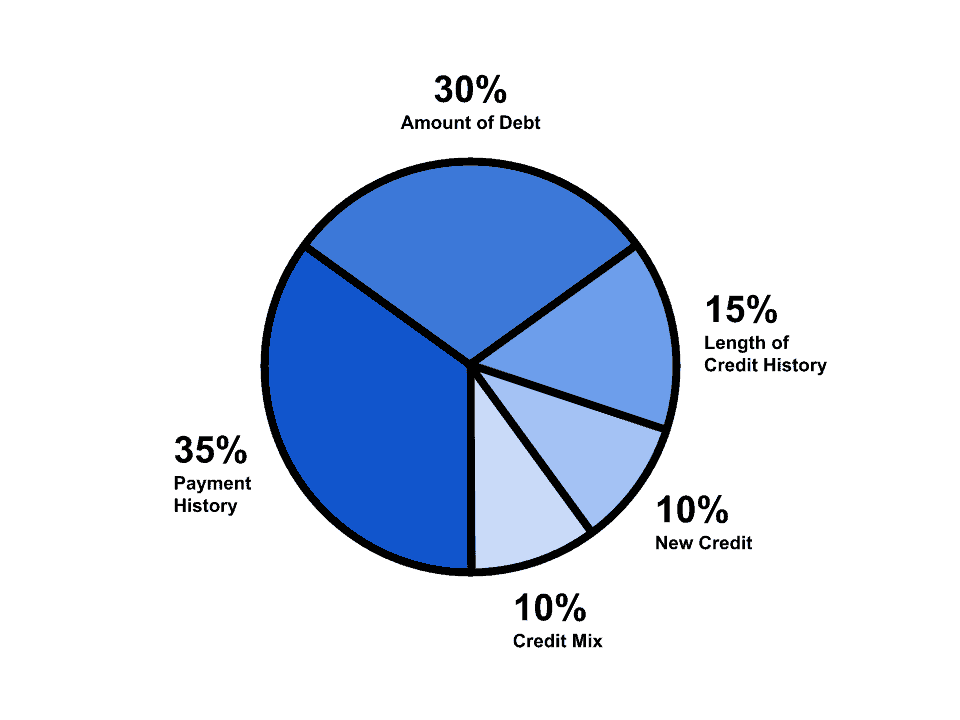

Now let’s take a look at what goes into your credit score:

As you can see, credit history (how long you have used credit) is a large part of your credit score. This means that the earlier you begin using credit cards, the higher your credit score will be as long as you are repaying them on time and using them responsibly.

So how can you obtain a credit score as early as possible? Well, to get a credit card, you have to be 18 years old. Because you won’t have a credit score yet, which is a prerequisite for most credit cards, you should start by getting a Secured Credit Card.

“When a credit card is “secured,” it means money must be deposited with the credit card issuer in order to open an account. That money is known as a security deposit. And it’s held by the credit card issuer while the account is open, similar to the security deposit given to a landlord to rent an apartment” – Capital One.

The great thing about secured cards is that credit card companies will issue them even to people with no credit history because secured cards don’t function like regular cards. Unlike regular cards, there is no risk that you won’t pay off a secured card in time because it is pre-loaded with money. However, they still contribute to your credit score.

It’s best to get a secured credit card when you are as young as possible because this will maximize your credit history. Once you use a secured credit card for long enough, you will eventually build up a decent credit score. Then you can start applying for regular credit cards with better rewards.

The takeaways:

Here are the most important things you should take away from this article:

- Compound interest is a powerful concept that allows investors to generate large returns over a long period of time.

- Even as a teenager, you can begin investing by opening a custodial investment account with the help of your parents.

- ETFs are critical to generating consistent stock market returns by allowing you to easily diversify your portfolio.

- Having a good credit score is a very important part of personal finance that can affect your loan rates and even your ability to rent a home.

- Getting a secured credit card as soon as possible helps you to have the best credit score later down the line.

Thanks for reading!